Clothing Donation Chart For Taxes . Quires donors to value their items. These values are according to the. valuation guide for goodwill donors. the irs requires an item to be in good condition or better to take a deduction. an item of clothing that is not in good used condition or better for which you claim an income tax charitable contribution deduction of more than $500 requires. you may be able to claim the below tax deductions for some common clothing items you donated. you must take into consideration the quality and condition of your items when determining a value. Read our quick guide to learn how you can donate to charity personally or through your business, either. donating to charity and saving tax.

from eforms.com

valuation guide for goodwill donors. Read our quick guide to learn how you can donate to charity personally or through your business, either. you must take into consideration the quality and condition of your items when determining a value. you may be able to claim the below tax deductions for some common clothing items you donated. These values are according to the. an item of clothing that is not in good used condition or better for which you claim an income tax charitable contribution deduction of more than $500 requires. the irs requires an item to be in good condition or better to take a deduction. donating to charity and saving tax. Quires donors to value their items.

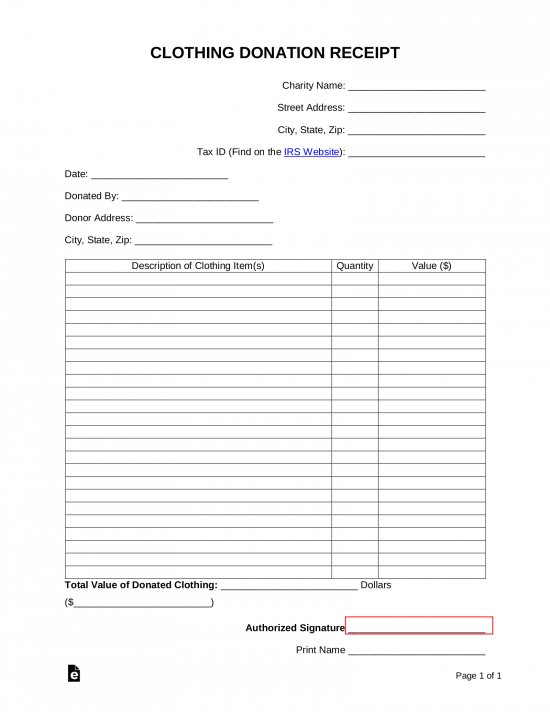

Free Clothing Donation Tax Receipt PDF Word eForms

Clothing Donation Chart For Taxes Quires donors to value their items. you may be able to claim the below tax deductions for some common clothing items you donated. the irs requires an item to be in good condition or better to take a deduction. These values are according to the. donating to charity and saving tax. valuation guide for goodwill donors. an item of clothing that is not in good used condition or better for which you claim an income tax charitable contribution deduction of more than $500 requires. Quires donors to value their items. you must take into consideration the quality and condition of your items when determining a value. Read our quick guide to learn how you can donate to charity personally or through your business, either.

From printablemediaells.z21.web.core.windows.net

How To Determine Value Of Donated Clothing Clothing Donation Chart For Taxes Quires donors to value their items. you must take into consideration the quality and condition of your items when determining a value. These values are according to the. Read our quick guide to learn how you can donate to charity personally or through your business, either. valuation guide for goodwill donors. an item of clothing that is. Clothing Donation Chart For Taxes.

From printablemediaecce.z22.web.core.windows.net

Table Of Values For Donated Clothing Clothing Donation Chart For Taxes the irs requires an item to be in good condition or better to take a deduction. you may be able to claim the below tax deductions for some common clothing items you donated. These values are according to the. you must take into consideration the quality and condition of your items when determining a value. donating. Clothing Donation Chart For Taxes.

From templatelab.com

34 Professional Donation & Fundraiser Tracker Templates ᐅ TemplateLab Clothing Donation Chart For Taxes an item of clothing that is not in good used condition or better for which you claim an income tax charitable contribution deduction of more than $500 requires. Quires donors to value their items. These values are according to the. valuation guide for goodwill donors. donating to charity and saving tax. Read our quick guide to learn. Clothing Donation Chart For Taxes.

From www.pinterest.com

Donation Values — Community Threads Foundation garment, Donate Clothing Donation Chart For Taxes you must take into consideration the quality and condition of your items when determining a value. donating to charity and saving tax. an item of clothing that is not in good used condition or better for which you claim an income tax charitable contribution deduction of more than $500 requires. the irs requires an item to. Clothing Donation Chart For Taxes.

From learningschooljfreyre8d.z22.web.core.windows.net

Clothing Donation Worksheet For Taxes Clothing Donation Chart For Taxes valuation guide for goodwill donors. you must take into consideration the quality and condition of your items when determining a value. you may be able to claim the below tax deductions for some common clothing items you donated. These values are according to the. the irs requires an item to be in good condition or better. Clothing Donation Chart For Taxes.

From db-excel.com

Itemized Deductions Spreadsheet intended for Amazing Goodwill Donation Clothing Donation Chart For Taxes Read our quick guide to learn how you can donate to charity personally or through your business, either. These values are according to the. Quires donors to value their items. you must take into consideration the quality and condition of your items when determining a value. donating to charity and saving tax. an item of clothing that. Clothing Donation Chart For Taxes.

From www.wikihow.com

How to Calculate Clothing Donations for Taxes 14 Steps Clothing Donation Chart For Taxes the irs requires an item to be in good condition or better to take a deduction. you may be able to claim the below tax deductions for some common clothing items you donated. Quires donors to value their items. Read our quick guide to learn how you can donate to charity personally or through your business, either. . Clothing Donation Chart For Taxes.

From lessonfullmonachist.z13.web.core.windows.net

Itemized Donation List Printable 2023 Clothing Donation Chart For Taxes These values are according to the. you must take into consideration the quality and condition of your items when determining a value. donating to charity and saving tax. the irs requires an item to be in good condition or better to take a deduction. an item of clothing that is not in good used condition or. Clothing Donation Chart For Taxes.

From www.wikihow.com

How to Calculate Clothing Donations for Taxes 14 Steps Clothing Donation Chart For Taxes Read our quick guide to learn how you can donate to charity personally or through your business, either. Quires donors to value their items. the irs requires an item to be in good condition or better to take a deduction. valuation guide for goodwill donors. These values are according to the. you may be able to claim. Clothing Donation Chart For Taxes.

From www.pinterest.com

IRS Clothing Donation Guidelines Guidelines, Irs Clothing Donation Chart For Taxes Read our quick guide to learn how you can donate to charity personally or through your business, either. an item of clothing that is not in good used condition or better for which you claim an income tax charitable contribution deduction of more than $500 requires. valuation guide for goodwill donors. you may be able to claim. Clothing Donation Chart For Taxes.

From materialfulldelation.z13.web.core.windows.net

Worksheet For Charitable Clothing Donations Clothing Donation Chart For Taxes These values are according to the. you may be able to claim the below tax deductions for some common clothing items you donated. an item of clothing that is not in good used condition or better for which you claim an income tax charitable contribution deduction of more than $500 requires. you must take into consideration the. Clothing Donation Chart For Taxes.

From eforms.com

Free Clothing Donation Tax Receipt PDF Word eForms Clothing Donation Chart For Taxes Read our quick guide to learn how you can donate to charity personally or through your business, either. you must take into consideration the quality and condition of your items when determining a value. donating to charity and saving tax. an item of clothing that is not in good used condition or better for which you claim. Clothing Donation Chart For Taxes.

From www.coupons.com

Maximize Tax WriteOffs by Tracking Donations thegoodstuff Clothing Donation Chart For Taxes donating to charity and saving tax. valuation guide for goodwill donors. Read our quick guide to learn how you can donate to charity personally or through your business, either. These values are according to the. you must take into consideration the quality and condition of your items when determining a value. the irs requires an item. Clothing Donation Chart For Taxes.

From db-excel.com

Irs Donation Values Spreadsheet Printable Spreadshee irs donation value Clothing Donation Chart For Taxes the irs requires an item to be in good condition or better to take a deduction. valuation guide for goodwill donors. an item of clothing that is not in good used condition or better for which you claim an income tax charitable contribution deduction of more than $500 requires. These values are according to the. donating. Clothing Donation Chart For Taxes.

From db-excel.com

Tax Donation Spreadsheet Pertaining To Clothing Donation Tax Deduction Clothing Donation Chart For Taxes valuation guide for goodwill donors. Quires donors to value their items. you may be able to claim the below tax deductions for some common clothing items you donated. Read our quick guide to learn how you can donate to charity personally or through your business, either. These values are according to the. an item of clothing that. Clothing Donation Chart For Taxes.

From learningcampusfox.z1.web.core.windows.net

Clothes Donation Value Guide Clothing Donation Chart For Taxes These values are according to the. an item of clothing that is not in good used condition or better for which you claim an income tax charitable contribution deduction of more than $500 requires. Quires donors to value their items. donating to charity and saving tax. Read our quick guide to learn how you can donate to charity. Clothing Donation Chart For Taxes.

From learningschoolaisinan35.z4.web.core.windows.net

Goodwill Itemized Donation List Printable Clothing Donation Chart For Taxes Quires donors to value their items. you must take into consideration the quality and condition of your items when determining a value. donating to charity and saving tax. valuation guide for goodwill donors. you may be able to claim the below tax deductions for some common clothing items you donated. These values are according to the.. Clothing Donation Chart For Taxes.

From db-excel.com

Clothing Donation Worksheet For Taxes — Clothing Donation Chart For Taxes you must take into consideration the quality and condition of your items when determining a value. Read our quick guide to learn how you can donate to charity personally or through your business, either. valuation guide for goodwill donors. donating to charity and saving tax. the irs requires an item to be in good condition or. Clothing Donation Chart For Taxes.